Introduction: Clarifying Two Critical HR Functions

Within Human Resources, payroll and compensation & benefits (C&B) are two pillars that often get lumped together — and understandably so. Both deal with how employees are paid and rewarded, but the difference between payroll and compensation and benefits is far more significant than it may appear on the surface.

It’s not uncommon to hear even seasoned professionals refer to these functions interchangeably. However, this confusion can lead to inefficiencies in HR operations and compliance, not to mention gaps in employee satisfaction and organizational strategy. That’s why understanding the HR functions payroll vs C&B is more than just a technical distinction — it’s a strategic imperative.

Payroll, in HR terms, is primarily transactional — focused on calculating salaries, deducting taxes, and ensuring timely payment. On the other hand, compensation and benefits in HR is about the bigger picture: designing pay structures, benchmarking roles, developing bonus systems, and curating benefit offerings that attract and retain talent.

As HR leaders, practitioners, or even HR tech adopters, recognizing the payroll vs compensation and benefits distinction is critical. It helps streamline processes, maintain compliance, and align reward systems with organizational goals. Moreover, as businesses grow, this clarity becomes essential in building a robust HR compensation strategy that fuels performance and engagement.

In the sections that follow, we’ll dive deeper into how payroll vs C&B roles differ, where they intersect, and why both are equally vital to your HR operations and compliance frameworks.

What Is Payroll in HR?

Payroll in HR is an essential process that ensures employees are compensated accurately and on time. It encompasses the full cycle of calculating, recording, and disbursing salaries, while also handling all statutory deductions. This function is central to HR’s role in ensuring smooth payroll and benefits administration and maintaining HR operations and compliance.

Key Components of Payroll

- Salary Computation (Gross to Net):

- Gross Salary Calculation: This includes all forms of compensation, such as base salary, allowances (e.g., housing, transport), and any bonuses or incentives.

- Net Salary Determination: After adding the gross earnings, HR deducts various statutory and voluntary deductions to arrive at the net pay that an employee will receive. These deductions include tax withholdings, retirement contributions, and insurance premiums.

- Tax Deductions (TDS, PF, ESI):

- Tax Deducted at Source (TDS): The payroll system must compute the appropriate TDS (taxes) according to the employee’s income tax slab and other exemptions or rebates.

- Provident Fund (PF) Contributions: The Provident Fund deduction is a statutory requirement that contributes to an employee’s retirement savings. Both the employer and employee contribute towards PF.

- Employees’ State Insurance (ESI): ESI is applicable to certain employees and provides them with medical and other welfare benefits. Payroll must account for these contributions and ensure they are processed correctly.

- Payslip Generation:

- Payslip Creation: After all calculations and deductions, the payroll department generates itemized payslips for employees, which break down the total earnings, deductions, and net pay.

- Detailed Breakdown: A payslip includes vital information such as basic salary, variable pay, bonuses, taxes, and benefits. It ensures transparency and helps employees understand their compensation.

- Compliance Reporting:

- Statutory Reporting: HR must prepare necessary reports for tax authorities, labor departments, and other regulatory bodies. This includes submitting returns related to TDS, PF, and ESI, among others.

Regulatory Compliance: Payroll must comply with various labor laws and tax regulations to avoid penalties or legal issues. Timely submissions of returns and maintaining up-to-date records are vital for this.

Frequency & Focus of Payroll

Managed Monthly: Payroll is typically processed on a monthly basis, though it can vary depending on the organization’s pay cycle. The process usually begins with gathering input data, such as attendance and leave records, and ends with the disbursement of employee salaries.

Transactional & Compliance-Oriented Focus: The primary focus of payroll is on accuracy and compliance. Payroll is a transactional process where HR must handle calculations, deductions, and disbursements with precision. Errors can lead to delays in salary payments, legal issues, or employee dissatisfaction. Payroll must also adhere strictly to regulatory requirements, as failure to comply with tax and labor laws can lead to penalties or audits.

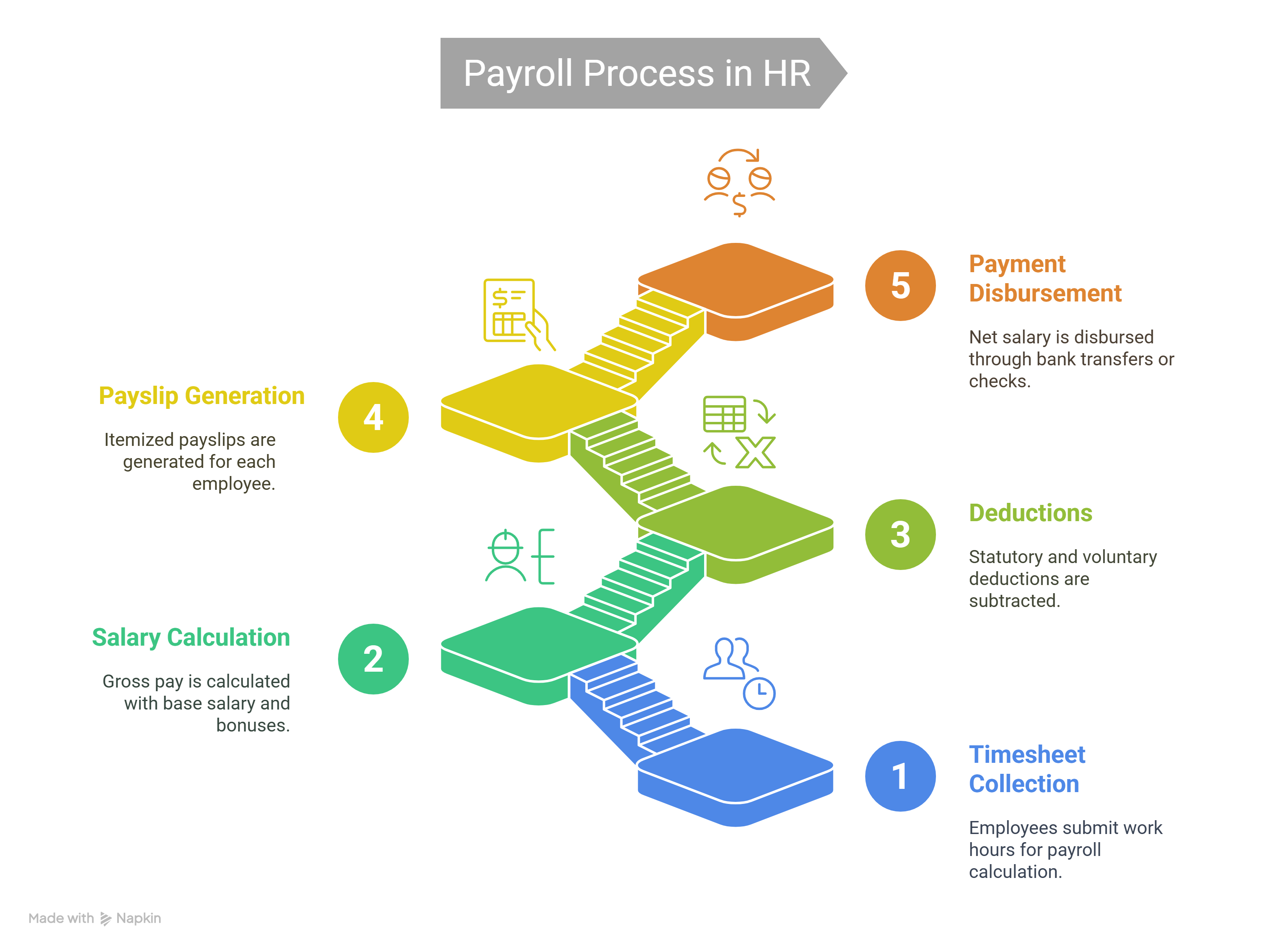

- Timesheet Collection:

Employees submit their work hours or attendance data, which serves as the foundation for payroll calculation. - Salary Calculation:

Gross pay is calculated, factoring in base salary, overtime, bonuses, and other earnings. - Deductions:

Statutory deductions like TDS, PF, and ESI, along with any voluntary deductions, are subtracted. - Payslip Generation:

An itemized payslip is generated for each employee, showing their total earnings and deductions. - Payment Disbursement:

The final net salary is disbursed through bank transfers or physical checks.

Typical Pain Points in Payroll

- Late Approvals: One of the most common pain points in payroll is delays caused by late approvals of timesheets, leave requests, or overtime. Payroll processing heavily relies on timely and accurate data from various departments. If managers or supervisors fail to approve attendance or overtime requests in time, it can hold up the entire payroll cycle. This results in delays in salary disbursements and may cause dissatisfaction among employees.

Delays in salary payments can lead to employee frustration, especially if they rely on regular paychecks. In some cases, the delay might also result in legal or compliance issues, as certain countries have strict timelines for salary payments.

- Manual Data Entry Errors: Manual data entry is another key challenge in payroll. Inaccuracies or human errors when entering employee data, such as salary details, tax deductions, or bank account numbers, can lead to incorrect salary calculations. This can also extend to statutory deductions like TDS, PF, and ESI, resulting in over- or under-deductions, which can create compliance issues.

Mistakes in data entry can lead to payroll discrepancies, affecting employee trust and causing delays in payments. Moreover, incorrect tax deductions can expose the company to penalties from tax authorities or labor departments for non-compliance.

Mitigation Tips

- Self-Service Portals: To address the challenges of late approvals and data entry errors, self-service portals have become a game-changer in payroll administration. By implementing these systems, employees can update their own personal details (such as address, bank account information, and tax status), submit timesheets and leave requests, and track their earnings and deductions. This reduces the administrative burden on HR and minimizes the risk of errors due to manual data entry.

- Employees can submit and manage their own timesheets and requests, reducing delays in the payroll process.

- HR teams can review and approve data more efficiently, knowing it has been entered accurately by the employee.

- The self-service approach improves transparency and employee satisfaction, as individuals can easily access their pay and benefits information.

- Audit Checklists: Audit checklists are a valuable tool for ensuring payroll accuracy and compliance. Regular internal audits—backed by well-structured checklists—can help identify and correct discrepancies before they become larger issues. These checklists should cover key areas such as:

- Verification of employee attendance and leave balances

- Accuracy of tax and benefit deductions

- Proper processing of overtime and bonuses

- Cross-checking of payslips with bank transfers

- Verification of employee attendance and leave balances

By adopting a systematic auditing approach, HR can proactively catch errors and prevent them from affecting payroll outcomes. Regular audits also help ensure compliance with ever-changing tax laws, benefits regulations, and labor codes.

What Is Compensation and Benefits (C&B) in HR?

Compensation and Benefits (C&B) is a strategic HR function that focuses on designing and managing total rewards packages to attract, retain, and motivate employees. Unlike payroll, which is primarily transactional, C&B plays a more holistic role in ensuring that employees are compensated fairly while fostering a work environment that aligns with organizational goals. The objective is to create a competitive and sustainable compensation framework that not only meets legal requirements but also supports the company’s talent strategy.

Key Components of Compensation and Benefits (C&B)

- Base Salary Structure:

- Determining Pay Scales: The foundation of C&B is the base salary structure, which is the fixed amount employees receive for their role. Base salary is typically influenced by factors like job role, industry standards, company size, and geographical location. A well-defined base salary structure ensures that employees are paid fairly based on their skills, experience, and the value they bring to the organization.

- Market Competitiveness: It is important that base salary structures are regularly reviewed to stay competitive within the market. Organizations may conduct salary benchmarking studies to ensure their base salary ranges are in line with industry trends.

- Determining Pay Scales: The foundation of C&B is the base salary structure, which is the fixed amount employees receive for their role. Base salary is typically influenced by factors like job role, industry standards, company size, and geographical location. A well-defined base salary structure ensures that employees are paid fairly based on their skills, experience, and the value they bring to the organization.

- Variable Pay, Bonuses, and Stock Options:

- Variable Pay: These are non-fixed payments based on performance. This category includes commissions, sales incentives, and profit-sharing. Variable pay allows companies to reward employees for their performance and contributions, and it is often tied to measurable KPIs (Key Performance Indicators).

- Bonuses: Often tied to individual, team, or company-wide performance, bonuses are another key component of compensation that incentivizes high achievement and supports the company’s strategic objectives. They can be awarded annually, quarterly, or even based on specific milestones.

- Stock Options: For many organizations, particularly startups or public companies, offering stock options is a critical element of compensation. Stock options give employees the right to purchase company shares at a predetermined price, and are often used to align employee interests with the company’s long-term success. This approach fosters a sense of ownership and motivates employees to work toward increasing the company’s value.

- Variable Pay: These are non-fixed payments based on performance. This category includes commissions, sales incentives, and profit-sharing. Variable pay allows companies to reward employees for their performance and contributions, and it is often tied to measurable KPIs (Key Performance Indicators).

- Benefits: Benefits refer to the non-wage compensations provided to employees in addition to their base salary. They include:

- Health Insurance: Medical coverage is one of the most important benefits that employees expect. Health insurance plans may vary in coverage depending on the company’s budget and the region it operates in. This may include medical, dental, and vision care.

- Retirement Plans: To help employees save for their future, many organizations offer retirement benefits such as 401(k) plans or pension schemes. These plans can include matching contributions from the employer, which is an attractive perk for employees.

- Perks: These are non-monetary benefits that make the work environment more enjoyable. Examples include flexible working hours, employee discounts, on-site meals, free parking, and travel allowances. Offering these perks adds significant value to the employee experience and is especially important in highly competitive industries.

- Health Insurance: Medical coverage is one of the most important benefits that employees expect. Health insurance plans may vary in coverage depending on the company’s budget and the region it operates in. This may include medical, dental, and vision care.

Wellness Programs: These programs promote a healthy work-life balance and employee well-being. They can include gym memberships, mental health support, counseling services, stress management programs, and wellness allowances. Wellness initiatives are becoming increasingly popular as companies recognize their role in reducing burnout and improving employee productivity.

Tied Closely to Talent Strategy and Competitiveness

C&B is tightly linked to an organization’s talent strategy. A well-structured compensation and benefits program can be the key differentiator in attracting top talent, especially in competitive industries where highly skilled professionals are in high demand. By offering a compelling combination of base salary, variable pay, benefits, and unique perks, organizations can position themselves as employers of choice.

Competitiveness:

One of the primary goals of C&B is to ensure that the company’s total rewards package is competitive with industry standards. Organizations that offer higher-than-average base salaries, lucrative bonuses, or extensive benefits are more likely to attract and retain skilled talent. Similarly, a lack of competitive compensation and benefits may result in high employee turnover, difficulty recruiting top talent, and low employee morale.

The strategic aspect of C&B also ties into broader business goals, helping organizations align their compensation structures with long-term objectives like performance, profitability, and growth. When designed correctly, a well-rounded C&B strategy not only supports the recruitment of talent but also drives employee engagement and retention.

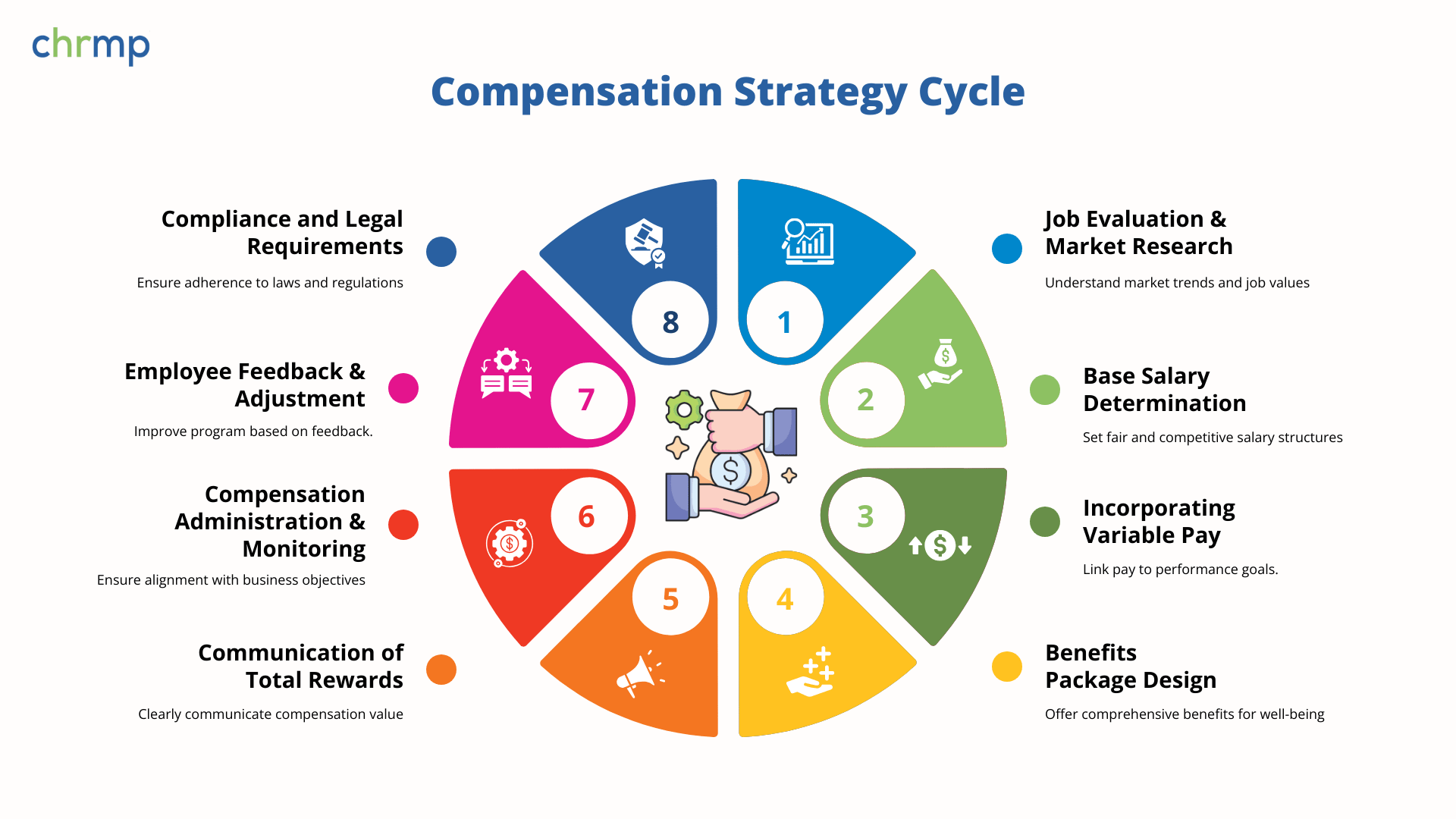

Step 1 (Job Evaluation & Market Research): This foundational step ensures that the company remains competitive in terms of salary offerings. Understanding the market is key to attracting top talent.

Step 2 (Base Salary Determination): After evaluating the market and job roles, HR sets fair and competitive salary structures that ensure internal equity.

Step 3 (Incorporating Variable Pay): By adding performance-based pay elements, HR encourages employees to achieve company goals, making compensation directly linked to performance.

Step 4 (Benefits Package Design): The goal here is to provide comprehensive benefits that go beyond salaries, focusing on employee well-being and satisfaction.

Step 5 (Communication of Total Rewards): Clear communication about total rewards ensures employees understand the full value of their compensation and benefits.

Step 6 (Compensation Administration & Monitoring): Regular monitoring ensures that the C&B strategy remains aligned with business objectives and continues to meet employees’ needs.

Step 7 (Employee Feedback & Adjustment): Collecting feedback helps improve the program over time and ensures that the company remains responsive to employee expectations.

Step 8 (Compliance and Legal Requirements): Legal compliance is non-negotiable; HR must continuously ensure that C&B is in line with local laws and regulations.

Payroll vs Compensation and Benefits: Key Differences

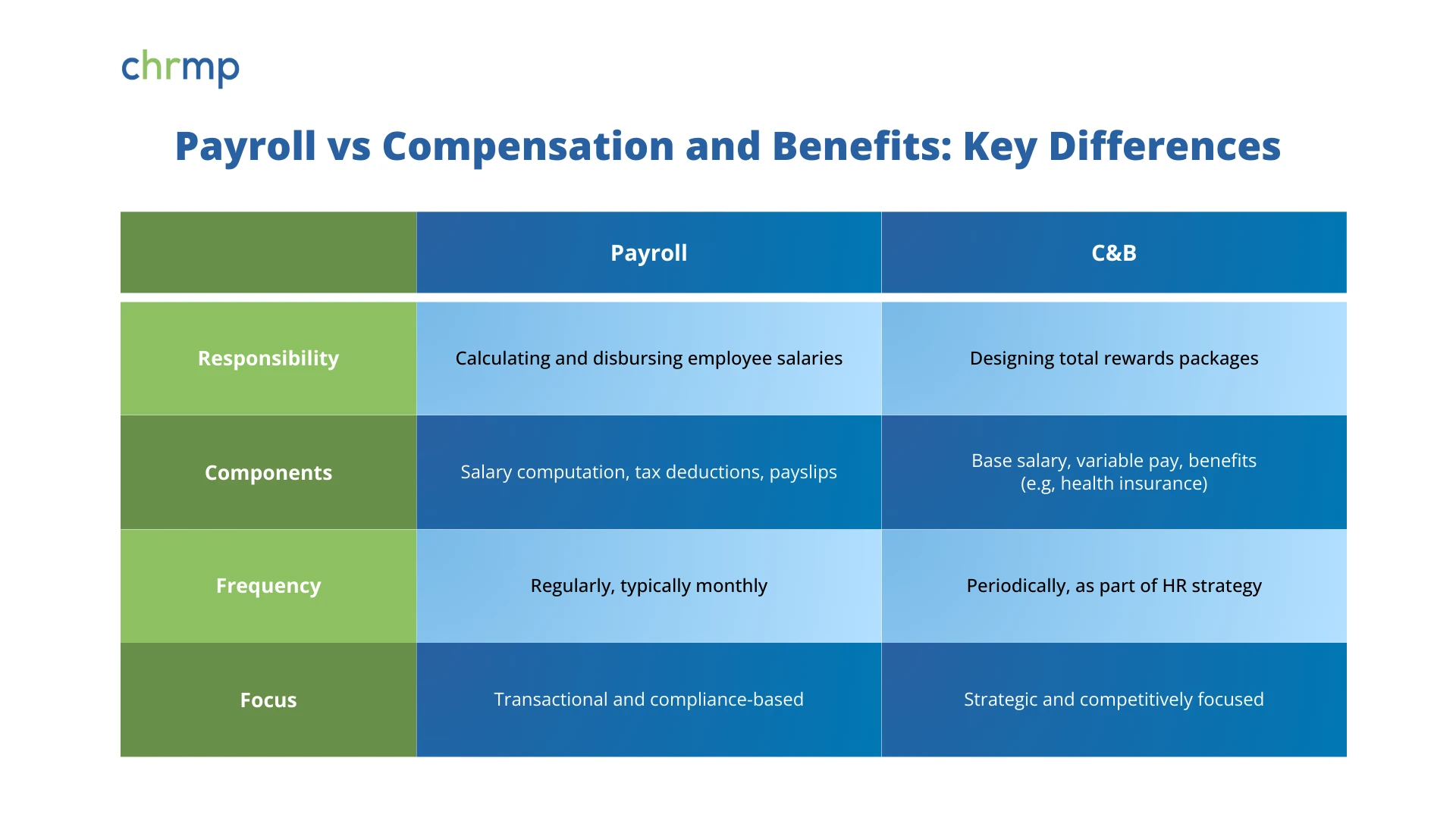

In HR, Payroll and Compensation & Benefits (C&B) may seem similar, but they are distinct functions that play different roles in managing employee compensation. Here’s a detailed comparison to help understand the differences:

What the Differences Mean

- Responsibility:

- Payroll: The primary responsibility of payroll is to ensure that employees are paid correctly and on time. This includes calculating salaries, handling tax deductions (like TDS, PF, ESI), and generating payslips. It is a routine and transaction-based task.

- C&B: On the other hand, C&B is responsible for designing total rewards packages. This involves establishing a base salary structure, planning variable pay (like bonuses), and developing benefits (e.g., health insurance, retirement plans).

- Payroll: The primary responsibility of payroll is to ensure that employees are paid correctly and on time. This includes calculating salaries, handling tax deductions (like TDS, PF, ESI), and generating payslips. It is a routine and transaction-based task.

- Components:

- Payroll: In payroll, the components are more transactional and focused on the calculation of salaries and the appropriate tax deductions. The payroll function also includes the generation of payslips and reporting to meet compliance standards.

- C&B: In C&B, the components are strategic and focus on base salary, variable pay (commissions, bonuses), and benefits (such as insurance, stock options, and wellness programs) that contribute to the overall employee experience.

- Payroll: In payroll, the components are more transactional and focused on the calculation of salaries and the appropriate tax deductions. The payroll function also includes the generation of payslips and reporting to meet compliance standards.

- Frequency:

- Payroll: Payroll is a regular, typically monthly, function. The payments to employees occur on a set schedule, and the payroll department needs to ensure that the payroll is processed accurately every pay period.

- C&B: C&B, on the other hand, is more periodic and linked to broader HR strategy. Adjustments to compensation and benefits packages happen periodically and are tied to factors such as employee performance, market changes, and organizational goals.

- Payroll: Payroll is a regular, typically monthly, function. The payments to employees occur on a set schedule, and the payroll department needs to ensure that the payroll is processed accurately every pay period.

- Focus:

- Payroll: The focus of payroll is primarily transactional and compliance-based. It ensures that the payroll process adheres to legal requirements and that employees receive the correct payments according to tax laws and company policies.

- C&B: In contrast, C&B is more strategic and competitively focused. It plays a significant role in the organization’s ability to attract and retain talent, aligning employee compensation with company goals and industry standards to maintain competitiveness.

- Payroll: The focus of payroll is primarily transactional and compliance-based. It ensures that the payroll process adheres to legal requirements and that employees receive the correct payments according to tax laws and company policies.

Interdependencies Between Payroll and C&B

While Payroll and Compensation & Benefits (C&B) are distinct functions, they are deeply interconnected and work together to ensure that employees are compensated fairly, accurately, and in line with company policies. The implementation of the C&B framework relies heavily on Payroll for execution, highlighting the critical need for collaboration between these two departments.

Payroll Implements the C&B Framework Through Accurate Processing

Once the Compensation & Benefits (C&B) team designs and finalizes a new rewards program, such as bonus schemes, variable pay structures, or new benefits packages, it is the Payroll team’s responsibility to accurately implement these changes. This involves adjusting payroll systems and ensuring that the new schemes are integrated into the upcoming payroll cycle.

For instance, when the C&B team introduces a new bonus structure for employees based on performance metrics, Payroll will need to update the system to calculate and distribute these bonuses accurately. This requires close communication and thorough understanding between both teams to ensure that all new compensation elements are processed in accordance with company policies and legal standards.

Example: New Bonus Scheme Implementation

Let’s consider an example: The C&B department designs a new bonus scheme to reward high-performing employees with quarterly bonuses. Once the scheme is established, it is up to Payroll to ensure that the scheme is properly integrated into the payroll system. Payroll will need to:

- Communicate with C&B to understand the eligibility criteria, bonus percentages, and payment schedules.

- Adjust the payroll system to account for the new bonus structure.

- Process and calculate the bonus amounts based on employee performance.

- Distribute the bonus along with the regular salary in the next payroll cycle.

Without this collaboration, there could be discrepancies in bonus distribution, delays, or errors, which can affect employee satisfaction and compliance.

Importance of Collaboration to Ensure Data Integrity and Compliance

For an organization to remain compliant with labor laws and tax regulations, the C&B and Payroll functions must collaborate regularly to ensure data integrity. Miscommunication or poor integration between these departments can lead to errors in tax deductions, benefit enrollments, or salary disbursements. It is crucial that both teams work closely to ensure that:

- Employee data (like salary changes, bonuses, benefits) is accurate and up-to-date.

- Regulatory compliance is maintained across all payroll and benefits processes.

- Data privacy and confidentiality are upheld, particularly when handling sensitive employee compensation information.

A breakdown in the collaboration between these two departments can result in issues like incorrect tax calculations, benefits being withheld from employees, or employees being underpaid or overpaid.

In conclusion, the seamless integration of Payroll and C&B is essential for the accurate and efficient management of employee compensation. Clear communication, regular audits, and robust data systems help ensure that both departments operate in tandem, meeting compliance standards and maintaining high employee satisfaction.

Who Manages What? Roles and Responsibilities

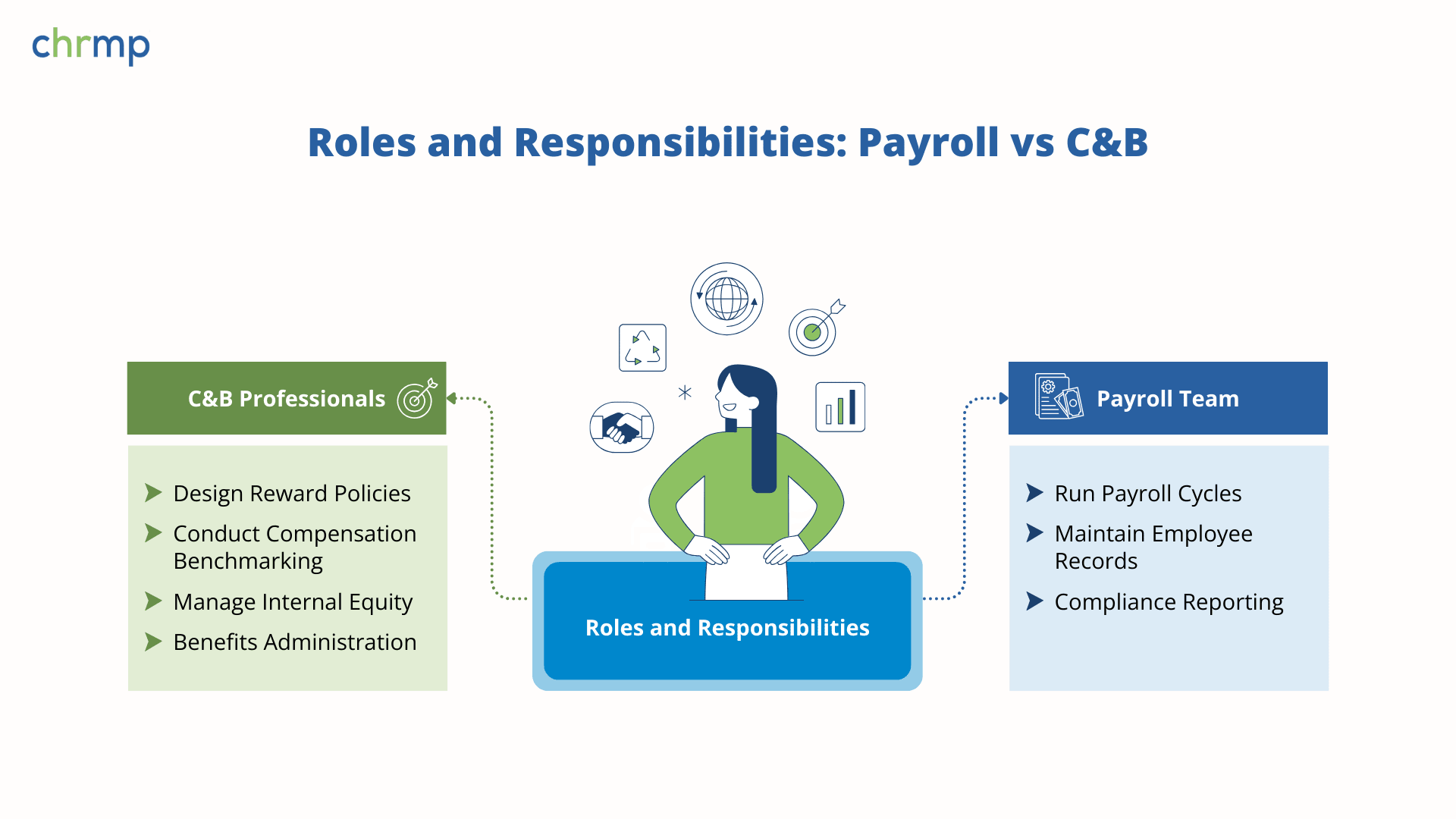

In any organization, Payroll and Compensation & Benefits (C&B) are distinct yet highly interdependent functions. Each team plays a specific role in ensuring the accurate compensation of employees and maintaining competitive, attractive benefits packages. Let’s dive into the roles and responsibilities of both Payroll Teams and C&B Professionals to understand the scope of their work in more detail.

Payroll Teams

The Payroll Team plays a crucial role in the day-to-day execution of compensation processing. Their responsibilities are centered around the accurate and timely disbursement of salaries and ensuring compliance with legal requirements.

Key Responsibilities of Payroll Teams:

- Run Payroll Cycles:

- The Payroll team is responsible for processing the salary payments for employees on a regular basis (typically monthly). This includes calculating the gross pay, deducting applicable taxes and benefits, and ensuring that net pay is accurate.

- They need to ensure that the correct compensation, bonuses, overtime, or commissions are accounted for and included in the payroll cycle.

- The Payroll team is responsible for processing the salary payments for employees on a regular basis (typically monthly). This includes calculating the gross pay, deducting applicable taxes and benefits, and ensuring that net pay is accurate.

- Maintain Employee Records and Tax Data:

- Payroll professionals maintain up-to-date employee records, including personal information, salary details, and tax data. They ensure that employees’ tax information (like TDS, PF, and ESI) is properly handled and that payroll is in compliance with relevant tax laws and regulations.

- They must also track employee absences, time off, and other forms of compensation, such as commissions and bonuses, and ensure that all deductions are accurate and in line with company policies.

- Payroll professionals maintain up-to-date employee records, including personal information, salary details, and tax data. They ensure that employees’ tax information (like TDS, PF, and ESI) is properly handled and that payroll is in compliance with relevant tax laws and regulations.

- Compliance Reporting:

- Payroll teams also handle statutory compliance requirements related to payroll, including generating reports for government agencies, tax authorities, and audit purposes.

- Payroll teams also handle statutory compliance requirements related to payroll, including generating reports for government agencies, tax authorities, and audit purposes.

This includes reporting on employee benefits, deductions, and ensuring that all payroll data is in accordance with the country’s legal framework.

C&B Professionals

Compensation and Benefits (C&B) Professionals are responsible for designing and implementing strategies to attract, retain, and motivate talent within an organization. Their role goes beyond transactional payroll activities, focusing on the bigger picture of employee satisfaction and the overall compensation strategy.

Key Responsibilities of C&B Professionals:

- Design Reward Policies:

- C&B professionals are responsible for designing comprehensive total rewards policies. These policies determine how employees will be compensated not just with base salary, but also with performance-related incentives, benefits, stock options, and wellness programs.

- They need to ensure that the reward structure is aligned with the company’s talent strategy, business objectives, and market competitiveness.

- Conduct Compensation Benchmarking:

- One of the core responsibilities of C&B professionals is compensation benchmarking. They compare their organization’s compensation structures with those of competitors and industry standards to ensure the company remains competitive in attracting and retaining talent.

- They regularly review the market trends and adjust compensation packages based on the cost of living, regional variations, and industry demands.

- Manage Internal Equity and Market Competitiveness:

- C&B professionals ensure internal equity, ensuring that employees who perform similar roles are paid fairly and consistently within the organization.

- They also manage the balance between market competitiveness and internal compensation to ensure that the company stays attractive to prospective talent, without going overboard in terms of cost.

- Regularly revising salary bands, bonus structures, and benefits packages ensures that the company maintains fairness and competitiveness.

- Benefits Administration:

- C&B professionals manage benefits programs such as health insurance, retirement plans, wellness initiatives, and more. They continually evaluate these benefits to ensure they meet employee needs and align with organizational goals.

By offering competitive benefits packages, C&B professionals help improve employee retention and engagement, as employees often value their benefits as much as their salary.

Collaboration Between Payroll and C&B Teams

While Payroll teams focus on the operational side, ensuring the accuracy of salary payments and compliance with legal frameworks, C&B professionals focus on creating and managing competitive, attractive compensation and benefits packages that contribute to employee satisfaction and retention.

Effective HR operations require constant communication and collaboration between the Payroll and C&B teams. Payroll needs to accurately implement the rewards and benefits structures designed by the C&B team. In turn, C&B professionals rely on payroll data to assess the success of their reward strategies and make adjustments as needed.

Understanding the roles and responsibilities of each team helps to ensure smoother workflows and effective execution of compensation and benefits programs. It’s essential for the Payroll Team and C&B Professionals to align their goals and work together seamlessly to ensure a positive experience for both employees and the organization.

Strategic vs Operational: How Both Functions Add Value

In any HR ecosystem, both Payroll and Compensation & Benefits (C&B) play essential roles, but they do so in distinct ways. While Payroll is primarily focused on operational aspects, ensuring efficiency, accuracy, and compliance, C&B is more strategic, focusing on creating a rewarding employee experience that aligns with the organization’s long-term goals. Together, they contribute significantly to an organization’s overall success by ensuring a seamless, well-rounded employee experience.

Payroll: Ensuring Operational Efficiency, Trust, and Compliance

The Payroll function is at the heart of an organization’s daily operations. Its core responsibilities revolve around ensuring that employee salaries, benefits, and other compensations are processed accurately and on time. Payroll teams handle the transactional side of compensation, which directly impacts operational efficiency, trust, and legal compliance.

- Operational Efficiency: Payroll ensures that payments are made on time without errors. A well-run payroll system minimizes delays and disruptions in employee pay, contributing to smooth day-to-day operations.

- Trust: Timely and accurate salary processing builds trust between the employees and the organization. When employees know they will be paid correctly and on schedule, it fosters a positive work environment and boosts overall morale.

- Compliance: Payroll ensures compliance with all statutory requirements such as tax deductions, benefit contributions, and labor laws. Ensuring that payroll is processed in accordance with legal standards reduces the risk of costly penalties and legal issues for the organization.

While Payroll is an operational function, it is undeniably critical for maintaining the stability of an organization’s workforce. When executed properly, it allows for smooth internal operations, while also safeguarding the company’s reputation.

C&B: Contributing to Employer Branding, Motivation, and Retention

On the other hand, Compensation & Benefits (C&B) is a more strategic function that focuses on attracting, retaining, and motivating talent. The C&B team designs comprehensive reward systems that align with organizational objectives and market standards. It also works to position the company as an attractive employer, helping to build a positive employer brand.

- Employer Branding: A well-structured C&B strategy contributes to strong employer branding. Competitive salaries, benefits, and perks attract top talent to the organization and set it apart from competitors. By offering unique benefits (e.g., wellness programs, flexible work arrangements), C&B helps position the company as a desired place to work.

- Motivation: C&B drives employee motivation by creating rewards programs that align with the aspirations of employees. Offering performance-based bonuses, stock options, and growth opportunities motivates employees to perform better, knowing that their efforts will be recognized and rewarded.

Retention: C&B also plays a pivotal role in employee retention. By providing attractive benefit packages, employees are more likely to stay long-term. Whether it’s through healthcare benefits, retirement plans, or work-life balance initiatives, C&B enhances employee satisfaction and reduces turnover.

How Payroll and C&B Work Together to Enhance Employee Experience and Workforce Stability

While Payroll focuses on operational tasks, C&B contributes to building an emotional connection with employees. Both functions work in tandem to create a stable and engaging employee experience.

- Payroll provides the foundation by ensuring that employees are paid accurately and on time, which builds trust and ensures compliance with regulations.

- C&B adds the strategic layer, offering rewarding programs that motivate employees, promote retention, and contribute to employer branding.

Together, Payroll and C&B form the backbone of employee experience. Their combined efforts support workforce stability, foster employee engagement, and help the organization thrive in a competitive talent market. While Payroll keeps things running smoothly on a day-to-day basis, C&B ensures the long-term satisfaction and engagement of employees.

Conclusion | Payroll vs Compensation & Benefits

In conclusion, while Payroll and Compensation & Benefits (C&B) serve distinct yet complementary roles within HR, both are critical to an organization’s success. Payroll focuses on the operational aspects—ensuring the accurate, timely processing of salaries, taxes, and benefits, which builds trust with employees and ensures legal compliance. It is the backbone of day-to-day operations, ensuring employees are paid correctly and on time. On the other hand, C&B takes a more strategic approach, designing competitive compensation packages and benefits programs that help attract top talent, motivate employees, and improve retention. By focusing on both employer branding and employee satisfaction, C&B plays a key role in shaping the company’s long-term talent strategy. When these functions collaborate effectively, they not only ensure the smooth functioning of payroll operations but also enhance the overall employee experience, contributing to a stable, engaged, and high-performing workforce. Together, Payroll and C&B are the pillars that support an organization’s efforts to remain competitive and compliant, while fostering a positive work environment that benefits both employees and the company.